is an inheritance taxable in michigan

What is Michigan tax on an inherited IRA. When you inherit an annuity the payments you.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

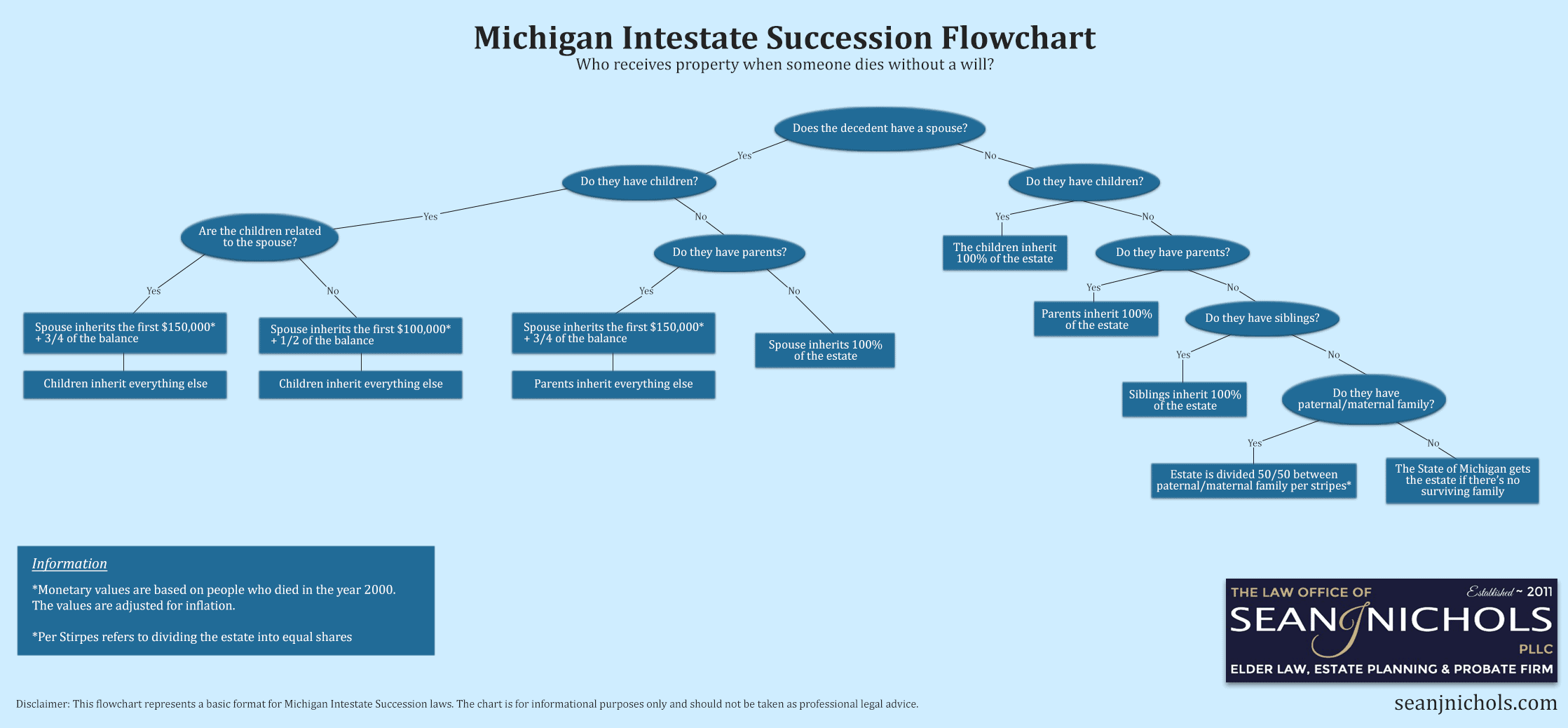

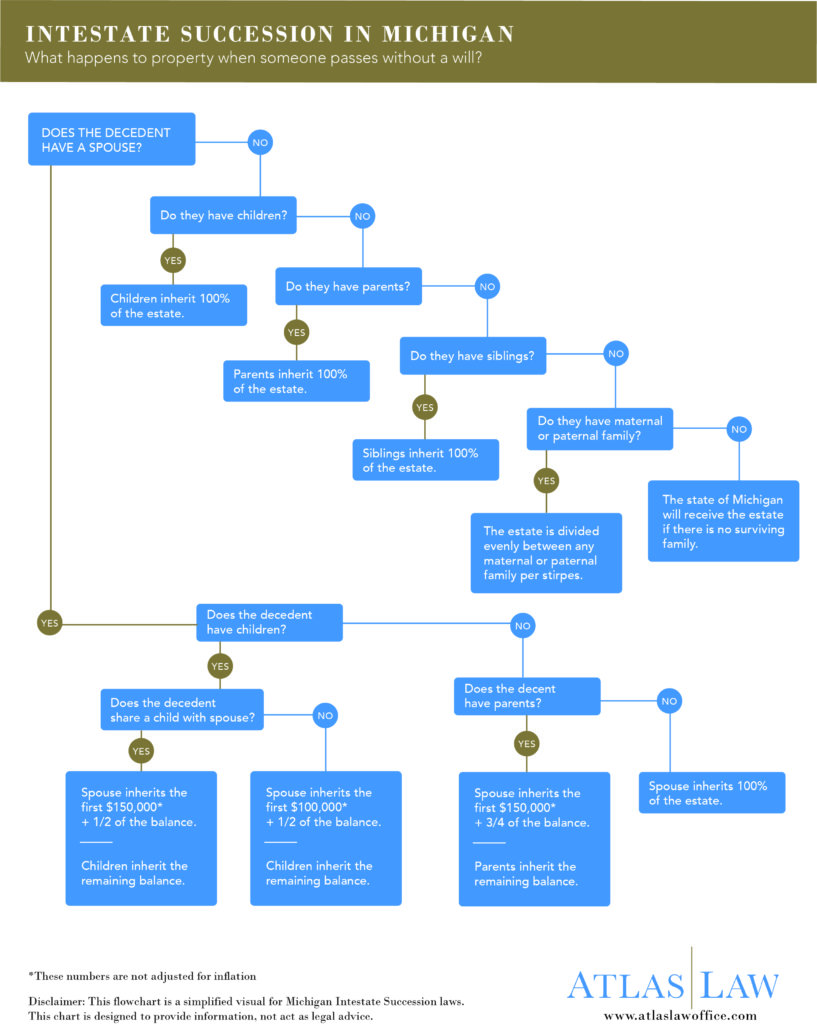

As a result the Michigan Inheritance Tax is only applicable to people who inherited.

. The Michigan inheritance tax was eliminated in 1993. MI HAD an inheritance tax for estates of decedents who passed away prior to 10193. I will be splitting it with my sisters.

As you can imagine this tax can have a big impact when. An inheritance tax is a tax on the right to receive property by inheritance. Michigan Estate Tax.

A copy of all inheritance tax orders on file with the Probate Court. Michigan does have an inheritance tax. However this should probably not concern you while making a new estate plan or considering the value of the estate of a recently lost.

Thursday February 20th 2020 407 pm. State inheritance tax rates are dependent on the beneficiarys relationship to the deceased. Like the majority of states Michigan does.

There is only one thing you need to know about Michigan estate taxes on an inheritanceAs of December 31 2004 there is no death or estate tax for. For individuals who inherited from a person who passed away on or before September 30 1993 the inheritance tax remains. Ad Inheritance and Estate Planning Guidance With Simple Pricing.

Thats because Michigans estate tax depended on a provision in the Internal Revenue Tax Code allowing a state estate tax credit against the federal estate tax. Michigan Inheritance Tax and Gift Tax. A corporate tax also called corporation tax or company tax is a direct tax imposed on the income or capital of corporations or analogous legal entities.

Call us at 586 268-4200 for a free consultation. Inheritance Tax Exemptions. Is An Inheritance Taxable In Michigan.

In all six states a surviving spouse is exempt from. Is inheritance taxable in michigan. In short it depends on whether the sale counts as a gain or a loss.

Michigan Department of Treasury. The Michigan Inheritance Tax is still in effect even though the tax was eliminated in 1993. That tax is applied to a persons heirs after they have already received their inheritance.

Its applied to an estate if the deceased passed on or before Sept. An inheritance tax is a tool that governments sometimes use to tax assets that people get as part of an inheritance. Our Inherited Property In Divorce Michigan Attorneys can help you with your legal matters.

Michigan does not have an inheritance or estate tax but your estate will be subject to the Wolverine States inheritance. Mom recently passed and left an IRA with me listed as beneficiary. Generally no you usually dont include your inheritance in your taxable income.

When the owner begins payments the income he receives is taxed by the Internal Revenue Service IRS at his current tax rate. Menu Posted on January 17 2021 by. Where do I mail the information related to Michigan Inheritance Tax.

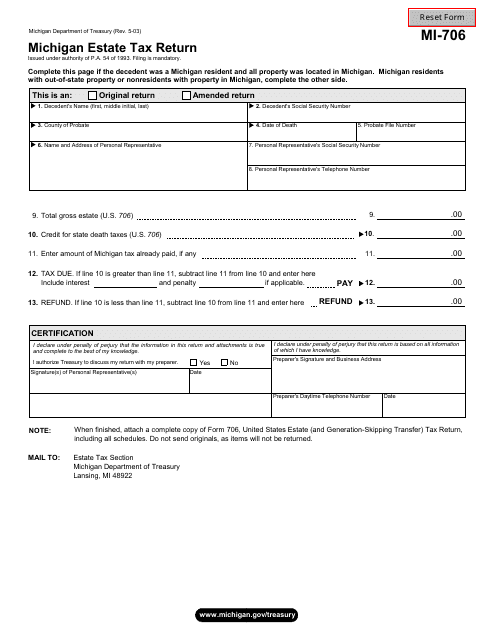

877 737-8800 248 590-6600. Maryland is the only state. A Federal Estate Tax return is required to be filed if the fair market value of the.

An inheritance tax a capital gains tax and an estate tax. However if the inheritance is considered income in respect of a decedent youll be subject to some taxes. In 2022 federal estate tax generally applies to assets over 1206 million and the estate tax rate.

Michigan does not have an inheritance tax with one notable exception. Different rules might apply due. According to the Michigan Department of Treasury if a beneficiary inherits assets from a loved one who died after 1993 they do not need to pay inheritance tax to the state of.

Mom had opted to have. There is no federal inheritance tax but there is a federal estate tax. The Michigan Inheritance Tax is still in effect even though the tax was eliminated in 1993.

Michigan Inheritance Tax Explained Rochester Law Center

Federal And Michigan Estate Tax Amounts On Inheritances

Estate Tax And Inheritance Tax Considerations In Michigan Estate Planning

Michigan Estate Tax Everything You Need To Know Smartasset

Michigan Probate Laws What You Need To Know

Does Michigan Still Have Death Taxes Kershaw Vititoe Jedinak Plc

Michigan Estate Tax Everything You Need To Know Smartasset

Form Mi 706 Download Fillable Pdf Or Fill Online Michigan Estate Tax Return Michigan Templateroller

Historical Michigan Tax Policy Information Ballotpedia

Michigan Estate Tax Everything You Need To Know Smartasset

Michigan Inheritance Laws What You Should Know

Michigan Inheritance Laws What You Should Know Smartasset

Michigan Inheritance Tax Explained Rochester Law Center

Michigan Inheritance Laws What You Should Know

Michigan Inheritance Tax Explained Rochester Law Center

Michigan Rules Of Intestate Succession Atlas Law

Michigan Inheritance Laws What You Should Know Smartasset