wisconsin auto sales tax rate

You may be penalized for fraudulent entries. Average Sales Tax With Local.

Shopify Sales Tax Setup Where And How To Collect Ledgergurus

United States vehicle sales tax varies by state and often by counties cities municipalities and localities within each state.

. State of Wisconsin. Form S-211 - Sales and Use Tax Exemption Certificate. Get a dealer license to sell more than five vehicles a year.

Municipal governments in Wisconsin are also allowed to collect a local-option sales tax that ranges from. Publication 202 517 Printed on Recycled Paper. The Wisconsin Department of Revenue DOR reviews all tax exemptions.

Department of Revenue Sales and Use Tax. Wisconsin collects a 5 state sales tax rate on the purchase of all vehicles. If you sell more than five or if you buy even.

However if a vehicle purchased in another state the District of Columbia or the Commonwealth of Puerto Rico is subject to sales tax in that jurisdiction a credit against. There are also county taxes of up to 05 and a stadium tax of up to 01. You may have to hire an attorney if the department cannot.

TeleFile Worksheet and Payment Voucher. Motor Vehicle Sales Leases and Repairs. With local taxes the total sales tax.

Some dealerships also have the option to charge a dealer service fee of 99 dollars. This lookup does not identify any other. Select View Sales Rates and Taxes then select city and add.

The Wisconsin sales tax is a 5 tax imposed on the sales price of retailers who sell license lease or rent tangible personal property certain coins and stamps certain leased property affixed to realty or certain digital goods or sell license perform or furnish taxable services in Wisconsin. 776 rows Wisconsin Sales Tax5. The Wisconsin Department of Transportation WisDOT collects wheel tax fees for the municipality or county keeps an administrative fee of 17 cents per vehicle application and.

The sales tax charged on car purchases in Wisconsin is 5 so you can expect to pay at least 5 of the total vehicle price for the tax fee. States with some of the highest sales tax on cars include Oklahoma 115 Louisiana. 31 rows The state sales tax rate in Wisconsin is 5000.

Some counties also charge a stadium tax of 01 percent notes the. You may use this lookup to determine the Wisconsin state county and baseball stadium district sales tax rates that apply to a location in Wisconsin. Wisconsin law says you can sell up to five vehicles titled in your name in 12 months.

Form ST-12 - Sales and Use Tax Return. Wisconsin residents must pay a 5 percent sales tax on car purchases plus county taxes of up to 05 percent. The total tax rate also depends on your county and local taxes which can be as high as 675.

If you have questions about how to proceed you can call the department at 608 266-1425. The total amount represents the various taxes and fees which are used to build and maintain Wisconsins roads. In Wisconsin the state sales tax rate of 5 applies to all car sales.

The Wisconsin state sales tax rate is 5 and the average WI sales tax after local surtaxes is 543. Wisconsin has a statewide sales tax rate of 5 which has been in place since 1961. Wisconsin has a 5 statewide sales tax rate but also has 100 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 0481.

Wisconsin law says you can sell up to five vehicles titled in your name in 12 months. Groceries and prescription drugs are exempt from the Wisconsin sales tax. All calculations are estimates based on all known state excise sales and.

Call DOR at 608 266-2776 with any sales tax exemption questions. In addition there may be county taxes. The Milwaukee County Wisconsin sales tax is 560 consisting of 500 Wisconsin state sales tax and 060 Milwaukee County local sales taxesThe local sales tax consists of a 050.

States With Highest And Lowest Sales Tax Rates

Wisconsin Sales Tax Small Business Guide Truic

How To Calculate Sales Tax For Your Online Store

Understanding California S Sales Tax

Nj Car Sales Tax Everything You Need To Know

Beginner S Guide To Dropshipping Sales Tax Blog Printful

Setting Up Sales Tax In Quickbooks Online

6 Differences Between Vat And Us Sales Tax

How Is Tax Liability Calculated Common Tax Questions Answered

Car Sales Tax In New York Getjerry Com

What Is Illinois Car Sales Tax

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

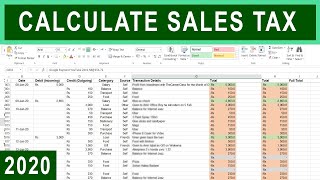

How To Calculate Sales Tax In Excel Tutorial Youtube

What S The Car Sales Tax In Each State Find The Best Car Price

Beginner S Guide To Dropshipping Sales Tax Blog Printful

How To Calculate Sales Tax Video Lesson Transcript Study Com

Wix Stores Setting Up Manual Tax Calculation Help Center Wix Com